Recent cases

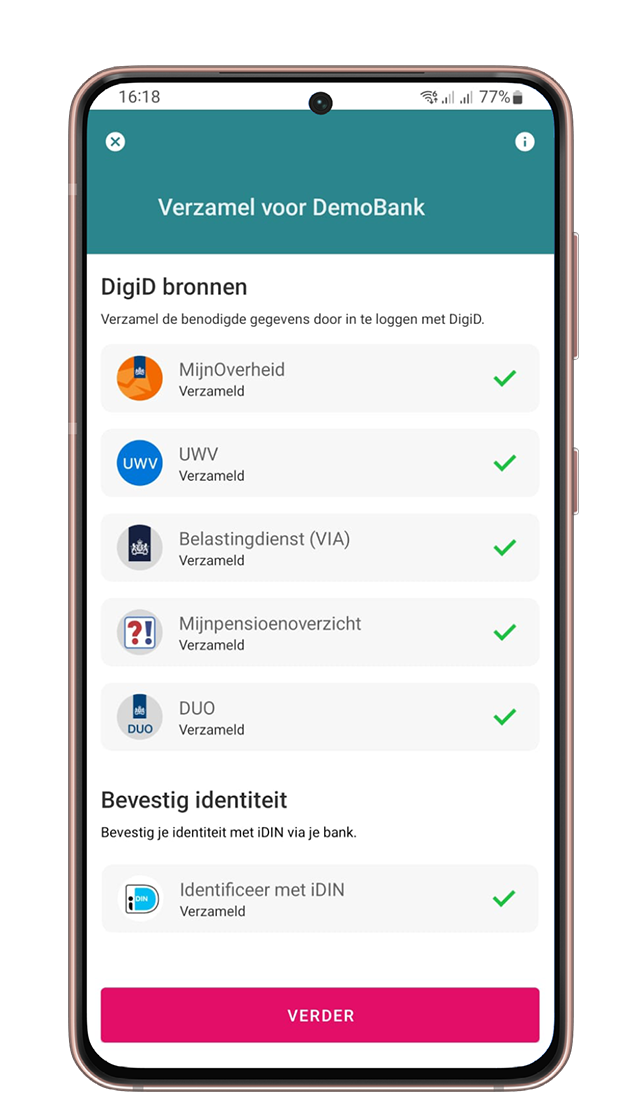

With Ockto, users log in to official government portals and other sources that hold information about their income, pension, assets, debts, taxes, and housing situation.

The Ockto platform securely retrieves the necessary data and presents it in a clear, safe, and seamless customer journey.

When the app is closed, all retrieved data is automatically deleted. Ockto never stores or uses this data. Only the authorized party that received permission can access and use it for the agreed purpose.

NL

NL FR

FR

Zoeken

Zoeken

Nederlands

Nederlands

.png)